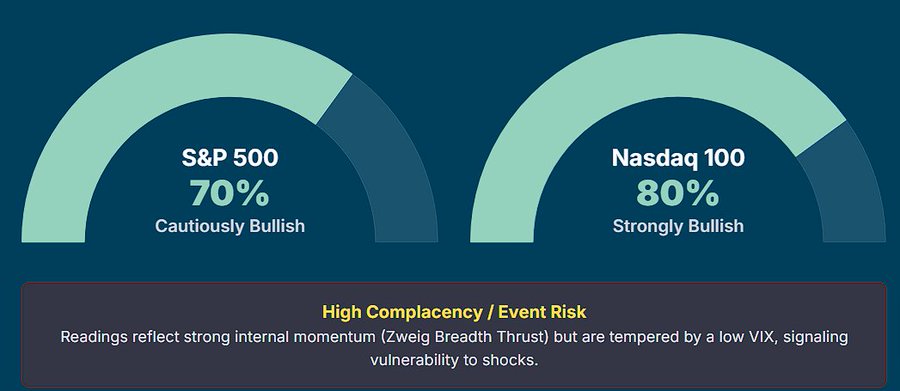

The Sentiment Gauge, July 2025

Our primary gauge synthesizes all data points into a single view. While both indices are bullish, the Nasdaq 100 shows stronger momentum due to the AI theme, but both are tempered by extreme complacency, signalling high near-term event risk.

High Complacency / Event Risk: Reading reflect strong momentum but are temepered by low VIX, signaling vulnerability to shocks.

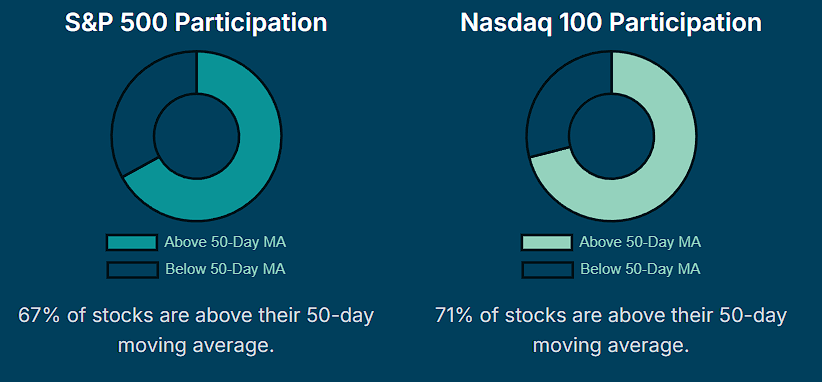

The Rally’s True Health

In stark contrast to the VIX, market breadth is exceptionally strong. A vast majority of stocks are participating in the rally, a sign of robust internal health and conviction from buyers.

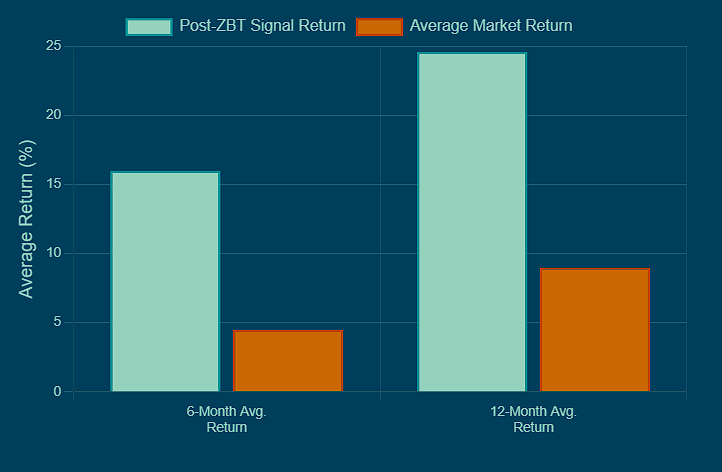

The Zweig Breadth Thrust:

A Flawless Bull Signal The market recently triggered a Zweig Breadth Thrust (ZBT), a rare signal marking a rapid shift from pessimism to widespread buying. Historically, this indicator has a perfect track record of predicting significant gains 6 and 12 months out.

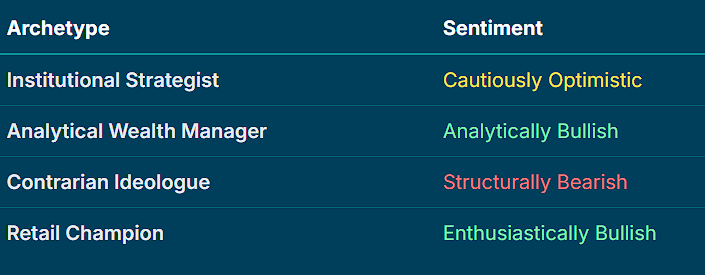

The Digital Bullhorn:

Polarized Voices Influential market commentators are not in agreement, reflecting a highly polarized investor landscape. This lack of consensus is a risk factor in itself.